This Is A “Network” Moment For Healthcare

by Kevin power

In the 1978 movie, Network, Peter Finch plays Howard Beale, a news anchor who experiences a “cleansing moment of clarity” when he realizes that the majority of his viewers have come to accept that the problems of the day were the normal state of affairs and that there was nothing that could be done to change things. He then goes on to exhort his viewers to go to the window and vent their frustrations in a loud voice so that everyone can hear them. Despite extreme nervousness and hostility from the media establishment, his network declines to cancel the show: he became a ratings hit because he touched a nerve that resonated with his audience. I believe we are having a “Network” moment in healthcare.

Technology has impacted every aspect of modern living and allowed us to manage our time more efficiently, organize our lives and finances, and ultimately expand our ability to learn. But healthcare, despite all of the technology advances, remains stubbornly stuck in a different time and place where ever taller silos of information dot the landscape and vast feats of engineering are required to extract that information, make it intelligible, and tie it together in a meaningful way- mainly for the providers and insurers. With all of the expenditure and effort to implement fully electronic health records, it is done largely with an eye to controlling costs or maximizing revenue but largely excludes or diminishes the role of the ultimate payor for all healthcare expenditures, the individual.

Listening to the debate about healthcare in the media and in political circles one could lose sight of a fundamental fact about health care costs and who pays for them. Stated simply, we do. Employer-provided health insurance coverage is a cost of doing business which ultimately has to be absorbed and passed on as part of the pricing decision or factored into overall compensation, possibly depressing salaries. Co-payments and out-of-pocket deductibles are paid by employees to fill the gaps in employer coverage. Also, a multitude of plans are available on health exchanges purchased by individuals, who pay out of pocket. And ultimately taxes help pay for Medicare, Medicaid, and federal subsidies for some health exchange purchased plans. The ultimate cost of healthcare is born by all of us in our roles as employee, consumer, patient, or citizen taxpayer. Each of us bears a portion of the cost of providing health care to the national population no matter which program provides the care.

One would imagine that with so much money being spent on healthcare- The Centers for Medicare and Medicaid Services estimate the amount exceeds some $3 trillion per year or more than 17% of GDP- that there would be greater transparency about coverage and pricing. Imagine going into a shop for a good or service where there is absolutely no information about a product’s characteristics or features, no comparative pricing, and no comparative measure of quality. That scenario could apply to consumer shops in East Germany or Poland before the Berlin Wall tumbled or equally to today’s healthcare system. But things are changing rapidly, primarily because of the availability of sophisticated smartphone and tablet technology and applications in the hands of everyday users- shifting the balance of power decidedly toward the consumer. Consumers, who already manage almost every aspect of their lives digitally from entertainment to travel, and banking, will insist on the same experience with regard to health. Healthcare providers and insurance companies are slowly adjusting to this new reality.

The digitization of healthcare requires more openness to all types of information which impact health. That means managing multiple sources of information from multiple systems and devices, many of which, increasingly, are at the consumer level. What is needed is to break down the silos within the healthcare industry itself that prevents rapid sharing. “Bring your own device (BYOD)” has already been established as corporate IT policy, explicitly accepting consumer devices as legitimate for corporate communications. The availability and usability of these devices has forced IT departments to scramble for security solutions to accept them, but it is happening. In healthcare, too often providers hide behind HIPAA compliance or concerns about security and privacy as a way of erecting hurdles to giving us copies of our own information. Yet some providers will decline to provide electronic copies of records but will provide records over one of the least secure methods still available today- the fax machine!

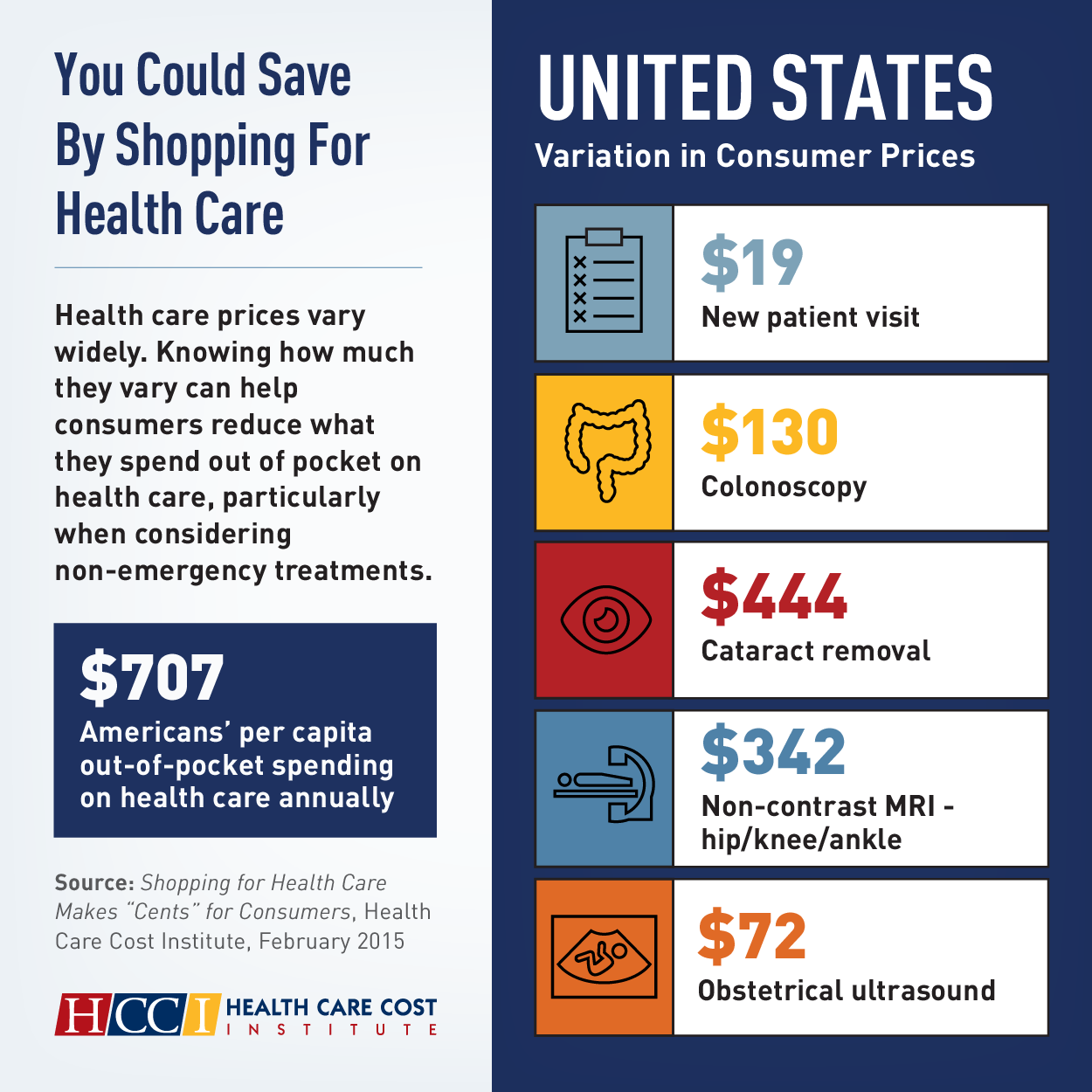

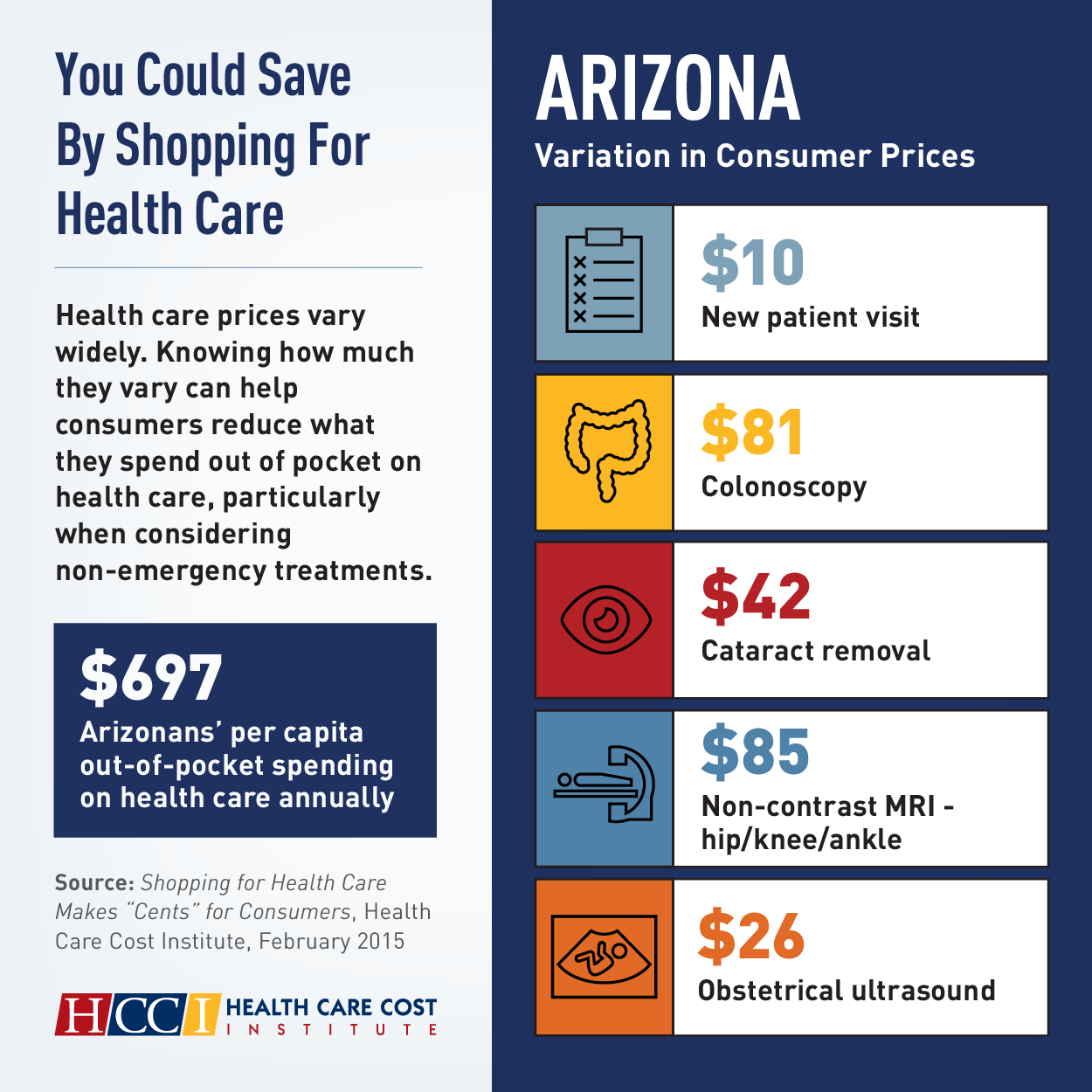

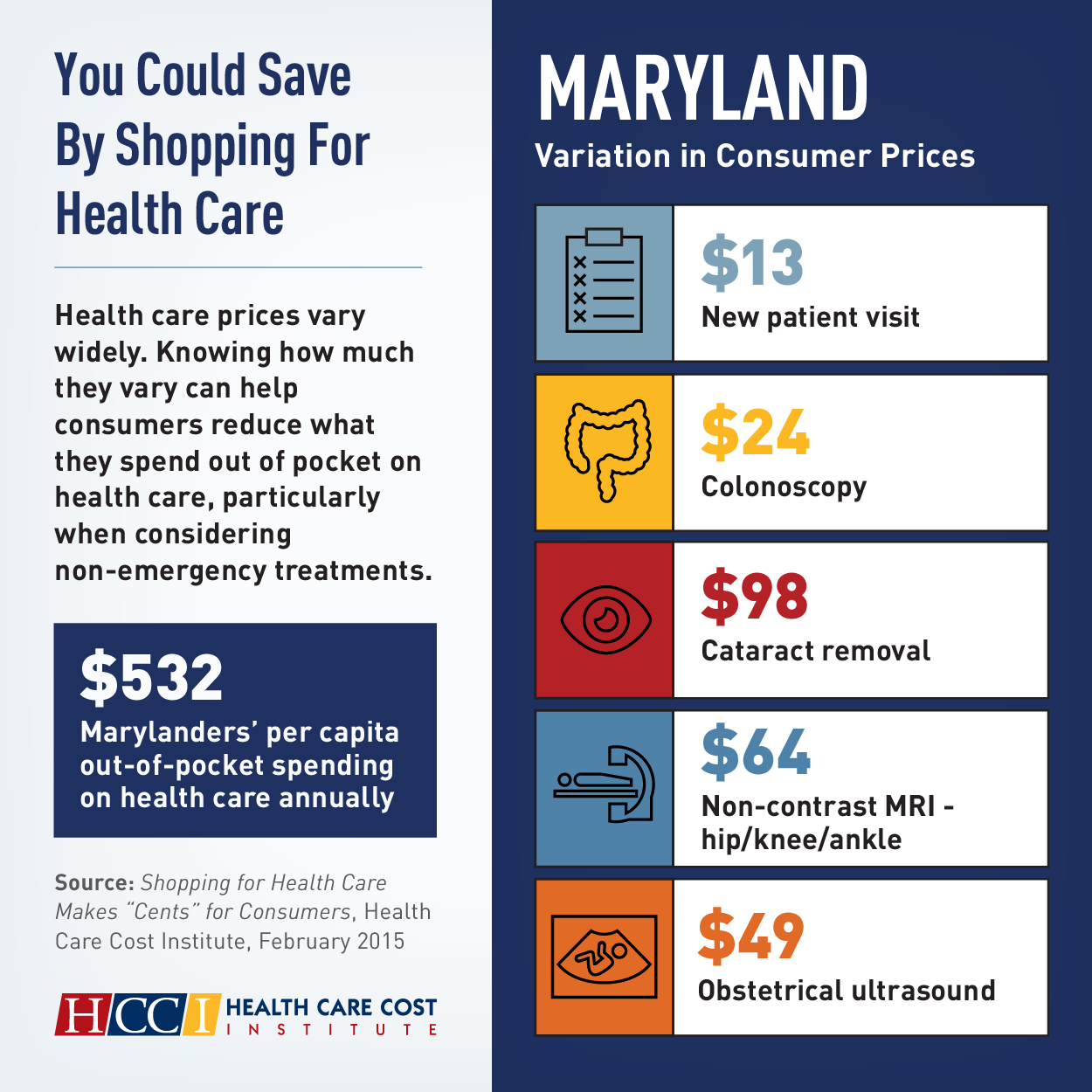

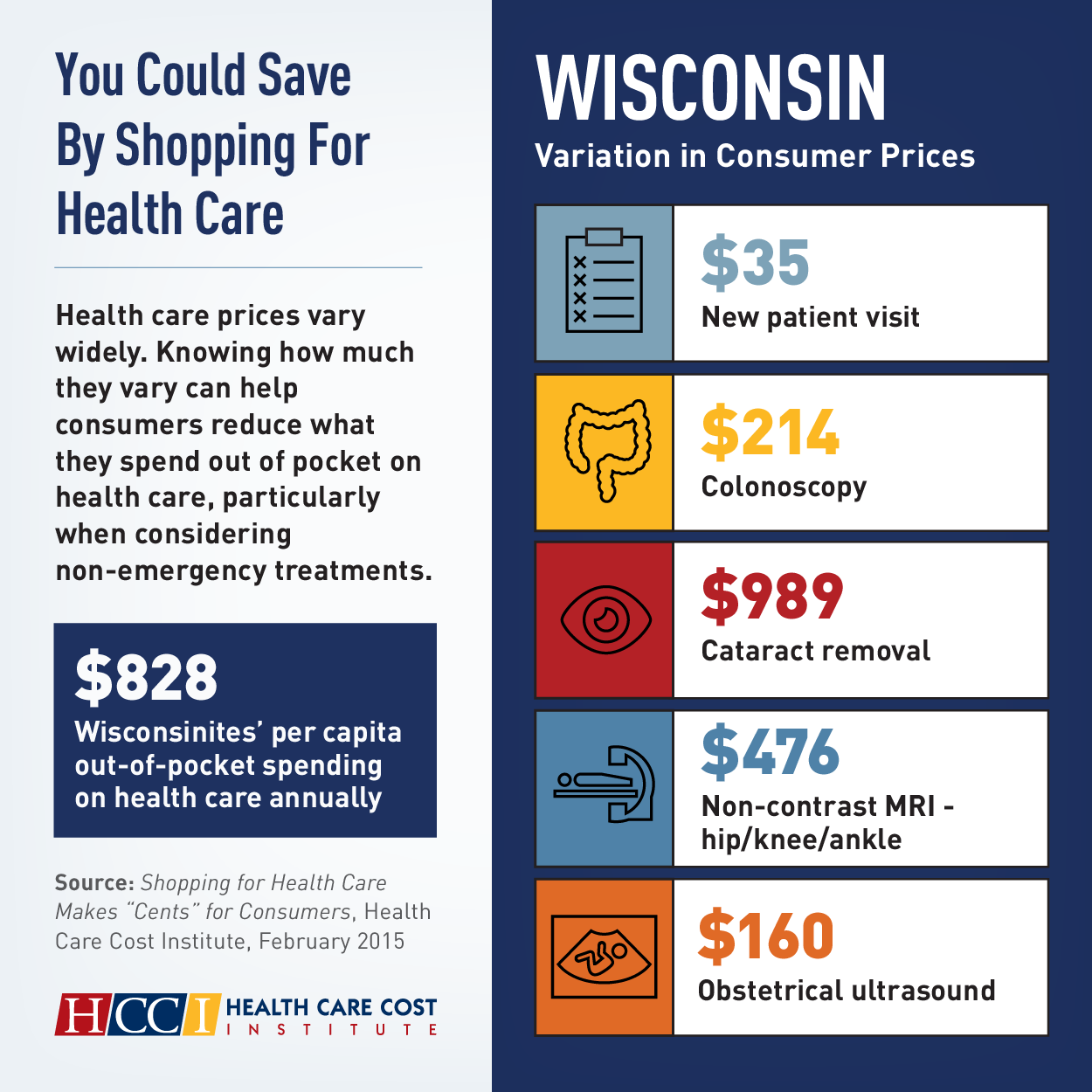

Healthcare consumers are increasingly bearing a greater proportion of the direct cost for their own care. Corporations and insurance companies are shifting costs to consumers in the form of higher premiums and deductibles, and higher co-pays for prescriptions. Over 30 percent of health insurance plans now ask for significant out-of-pocket costs, with employee contributions nearing $5,000 annually, according to The Kaiser Family Foundation. And plans with a high deductible or a consumer-directed component have increased from 17 percent in 2007 to 31 percent in 2012. This trend can only be expected to accelerate for the future. The latest hot button consumer issue, among many, is unauthorized “out of network” charges that are presented to individuals after treatment, often without their prior consent. Consumers are spending more and will inevitably want control over this mounting cost.

All actors have a stake in the outcome of the current healthcare debate and beyond. Employers want healthier employees and lower health insurance premiums, which can be accomplished by supporting greater consumer involvement. Insurance companies want to reduce cost and eliminate unnecessary testing. And consumers want lower premiums, lower out-of-pocket deductibles, and better health outcomes. Consumers ultimately need to understand pricing and the associated quality of different providers and treatments. And they need to actively manage their health as well as their healthcare expenditure.

The consumer has the most to gain in this equation: potentially lower cost and undoubtedly, better treatment, as a result of more readily available and accessible information, and tools to better manage their health and prevent illness. Fortunately, technology that is available to assist us in every other aspect of our daily lives can now be applied to the one which will benefit us the most, our health. Doctors, healthcare providers, and insurance companies must increasingly recognize that their clients are not passive recipients or just “patients”. Health “consumers” are here to stay. Their “Network” moment has arrived; but instead of simply venting their frustrations, they are becoming more motivated and involved, and they increasingly have the technology to make informed choices. In the new era of “choice” and mobility, providers and insurance companies who support and engage them will have a decided advantage in securing their loyalty.